Starting a family is a dream for many, but it can be costly, especially if you need help with IVF. The costs can add up quickly, and many people struggle to afford them.

It’s not fair that money should be a barrier to having a child. You might feel stressed and overwhelmed trying to figure out how to pay for treatments. The good news is that some states require insurance companies to cover IVF and other family-building options. This means you might have to help to pay for those costs!

This article will walk you through IVF and Family Building Insurance Coverage by State.

Understanding IVF and Family-Building Options

Okay, let’s break down what IVF and other family-building options are.

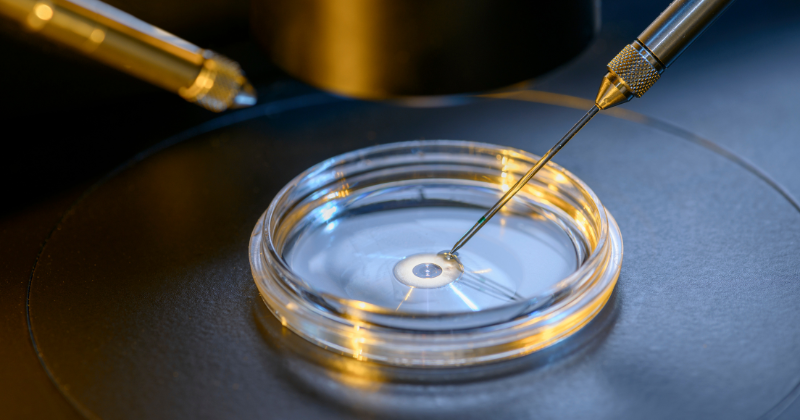

What is IVF?

IVF stands for in vitro fertilization. It’s a type of infertility treatment where an egg and sperm are combined in a lab to create an embryo. Then, the embryo is transferred to the uterus with the hope that it will implant and grow into a baby. IVF can be a long process with many steps and doesn’t always work the first time.

Who Needs IVF?

Many people need a little extra help to have a baby. Infertility services like IVF can help people who have problems with their eggs or sperm, blocked fallopian tubes, endometriosis, or other medical conditions. Sometimes, doctors can’t even figure out why a couple can’t get pregnant! That’s called unexplained infertility.

Other Ways to Build a Family

IVF isn’t the only way to build a family. Adoption, surrogacy, and foster care are other great options.

- Adoption: This is when you legally become the parent of a child who was not born to you.

- Gestational and traditional surrogacy: This is when another woman carries and delivers a baby for you. There are two main types of surrogacy:

- Traditional surrogacy: The surrogate uses her ogg.

- Gestational surrogacy: The surrogate carries an embryo created with the intended parents’ egg and sperm or with donor eggs or sperm.

- Foster care is when you provide a temporary home for a child who needs one.

Some insurance plans offer infertility coverage for things like adoption or surrogacy, but it depends on where you live and your specific plan.

For example, the Florida surrogacy program offers some financial assistance to eligible residents.

Why is Insurance So Important?

Fertility treatment and fertility preservation services can be super expensive. One cycle of IVF can cost tens of thousands of dollars, and you might need more than one cycle to be successful.

Adoption and surrogacy can also be very costly. That’s where insurance comes in. Having fertility benefits can make a HUGE difference. It can help reduce financial stress and make these options more affordable for people who want to build a family.

State-by-State Breakdown of IVF Insurance Coverage (2025)

Okay, now let’s dive into the good stuff! We’ve compiled a table showing each state’s infertility coverage. This will give you a quick overview of where your state stands.

Methodology: We examined state laws and regulations to determine what each state requires. We also checked with insurance companies to see what they offer.

| State | Mandate | Type of Mandate | Coverage Limits | Exclusions |

|---|---|---|---|---|

| Arkansas | Yes | IVF | $ 15,000-lifetime max | Pre-existing conditions (12-month wait) |

| California | Yes (Large Group) | IVF, Fertility Services | 3 oocyte retrievals, unlimited embryo transfers | Religious organizations exempt |

| California | No (Small Group) | |||

| Colorado | Yes (Large Group) | IVF, Fertility Preservation | 3 oocyte retrievals, unlimited embryo transfers | Religious organizations exempt |

| Connecticut | Yes | IVF, IUI, Ovulation Induction | 4 cycles ovulation induction, three cycles IUI, two cycles IVF | Religious organizations exempt |

| Delaware | Yes | IVF, Fertility Preservation | 6 egg retrievals, unlimited embryo transfers | Experimental procedures, <50 employees exempt |

| Hawaii | Yes | IVF | 1 IVF cycle | |

| Illinois | Yes | IVF, IUI, GIFT, ZIFT | 4 egg retrievals (up to 6 with live birth) | <25 employees exempt, religious employers exempt |

| Kentucky | Yes | Fertility Preservation | Oocyte and sperm preservation | Religious organizations exempt, self-insured employers exempt |

| Louisiana | Yes | Fertility Preservation | Oocyte and sperm preservation | It does not cover IVF |

| Maine | Yes | Fertility Diagnostic Care, Fertility Treatment, Fertility Preservation | Experimental procedures, non-medical costs related to donor gametes, donor embryos, or surrogacy | |

| Maryland | Yes | IVF | 3 IVF cycles per live birth, $ 100,000-lifetime max | <50 employees exempt, religious employers exempt |

| Massachusetts | Yes | IVF, IUI, GIFT, Fertility Preservation | No limit on cycles | Experimental procedures, surrogacy, reversal of voluntary sterilization |

| Montana | Yes | Fertility Preservation | Oocyte and sperm preservation | Religious organizations exempt, self-insured employers exempt |

| New Hampshire | Yes | IVF, Fertility Treatment, Fertility Preservation | Experimental procedures, non-medical costs related to third-party reproduction, reversal of voluntary sterilization | |

| New Jersey | Yes | IVF, IUI, Fertility Preservation | 4 egg retrievals, unlimited embryo transfers | Cryopreservation (except iatrogenic infertility), <50 employees exempt, religious employers exempt |

| New York | Yes | IVF (Large Group), Fertility Preservation | 3 IVF cycles (large group) | IVF excluded in individual and small group markets |

| Ohio | Yes | Infertility Services (Medically Necessary) | ||

| Oklahoma | Yes | Fertility Preservation | Religious employers can opt out | |

| Rhode Island | Yes | IVF, Fertility Preservation | $100,000 cap on treatment | |

| Texas | No | |||

| Utah | Yes (Public Employees) | IVF, Genetic Testing | $4,000 indemnity benefit | |

| Washington D.C. | Yes | IVF, Fertility Preservation | 3 rounds of IVF | |

| West Virginia | Yes | Infertility Services |

Important Notes

- Surrogacy: Insurance coverage for surrogacy is tricky. Many states don’t require it, but some do. If you’re considering surrogacy, be sure to do your research and ask your insurance company about their policies. You can also check out surrogacy FAQs online for more information.

- How many times can you be a surrogate mother? This depends on the agency or clinic you work with and your health history. There is no one-size-fits-all answer.

- In vitro fertilization is complex, and working with a qualified doctor and clinic is essential

This section gives you a good starting point for understanding IVF treatment coverage in your state.

But remember, insurance policies can be complicated! Always check your policy carefully and talk to your insurance company if you have questions.

Navigating Insurance Policies and Finding Resources

Okay, now you have a better idea of what your state requires regarding IVF coverage.

But how do you use that information to get the fertility services you need? Let’s break it down.

Understanding Your Policy

First things first, you need to understand your health insurance coverage. Insurance policies can be confusing, but don’t worry! Here are some tips:

- Look for keywords: When you read your policy, look for words like “infertility,” “assisted reproductive technology,” and “IVF coverage.” These words will help you find the information you need.

- Check for details: Pay attention to the details. Does your plan cover in vitro fertilization? How many cycles? Are there any age limits or other restrictions?

- Ask for help: If you don’t understand something, don’t hesitate to call your insurance company. They should be able to explain your coverage to you in simple terms.

Tips for Maximizing Coverage

Here are a few more tips to help you get the most out of your health insurance coverage:

- Pre-authorization: Some insurance companies require you to get pre-authorization before they will cover specific treatments. This means you need to get your insurance company’s approval before starting treatment.

- Referrals: Your insurance company might also require you to get a referral from your primary care doctor before you can see a specialist.

- Work with your doctor: Your doctor can be a great resource! They can help you understand your options and work with your insurance company to cover your treatments.

- Don’t give up: If your insurance company denies your claim, don’t give up! You can appeal the decision. Your doctor can help you with this process.

Resources and Support

Navigating infertility can be challenging, but you don’t have to do it alone! Here are some resources that can help:

- RESOLVE: The National Infertility Association: This organization provides information, support, and advocacy for people facing infertility.

- State-specific support groups: Connect with others going through the same thing.

- Financial assistance programs: Some organizations offer financial assistance to help people pay for fertility treatment.

Surrogacy: A Special Case

The surrogacy process can be incredibly complex when it comes to insurance. Many insurance plans don’t cover it, but some do.

If you’re considering surrogacy, here are some things to keep in mind:

- Check your policy: Carefully review your policy to see if surrogacy is covered.

- Talk to your insurance company: If you have questions, call your insurance company and ask about their policies.

- Find a qualified agency: Work with a reputable surrogacy agency that can help you navigate surrogacy’s legal and financial aspects.

- Consider a surrogate mother with insurance: Some surrogate mothers have insurance that covers some of the medical costs of surrogacy.

Remember, knowledge is power!

The more you know about your health insurance coverage and the resources available to you, the better equipped you’ll be to navigate the challenges of infertility and build the family of your dreams.

Looking Ahead: Trends and Advocacy

The world of infertility treatment is constantly changing. New technologies are being developed, and more people are speaking up about the need for better access to care.

So, what can we expect in the future?

Growing Awareness and Advocacy

More and more people are talking openly about infertility. This is awesome because it helps to reduce the stigma and encourages people to seek help. Advocates are also working hard to make infertility services more affordable and accessible.

Potential Impact of Federal Legislation

Right now, no federal law requires insurance companies to cover infertility treatment. But that could change! Some bills in Congress would make IVF coverage mandatory in all states. This would be a massive win for people who need help paying for these expensive treatments.

The Role of Employers

Employers can also play a significant role in expanding access to care. Many companies offer health insurance plans that include fertility benefits.

This can be a significant factor in helping employees afford fertility treatment and build their families.

What Can You Do?

You can make a difference! Here are some ways to get involved:

- Share your story: Talking about your experience with infertility can help raise awareness and encourage others to seek help.

- Support advocacy organizations: Many organizations are working to improve access to infertility treatment. You can support them by donating your time or money.

- Contact your lawmakers: Let your elected officials know that you support legislation improving access to infertility services.

The future of infertility treatment is looking brighter!

With continued advocacy and support, we can make these treatments more affordable and accessible for everyone who needs them.

Build A Family

Building a family can be challenging, especially when you need help with IVF. But remember, you’re not alone! Insurance can help with the costs; many states require coverage for some treatments. Understanding your health insurance plans and what they offer is super important. And don’t forget about the fantastic resources and support groups out there. With knowledge and support, you can navigate the challenges and achieve your dream of parenthood.

Frequently Asked Questions

What is the average cost of IVF?

IVF costs vary widely, but one cycle can range from $12,000 to $25,000 or more. This includes medications, procedures, and lab fees. It’s essential to get a detailed cost breakdown from your clinic.

Does insurance cover IVF for single people or same-sex couples?

It depends on your state and your insurance plan. Some states have laws that prohibit discrimination based on marital status or sexual orientation, but others don’t. Check your policy carefully.

What are the success rates of IVF?

Success rates vary based on factors like age, diagnosis, and clinic. On average, the live birth rate per IVF cycle for women under 35 is about 40%.

What are some alternatives to IVF?

If IVF isn’t an option for you, there are other ways to build a family. These include adoption, surrogacy, foster care, and donor eggs or sperm.

What should I do if my insurance denies my IVF claim?

Don’t give up! You have the right to appeal the decision. Work with your doctor and insurance company to understand the reason for the denial and gather any necessary documentation to support your claim.

Wendy Arker entered the field of infertility with a huge heart and passion to guild others on their quest to grow their own family after her personal journey with infertility and turning to egg donation and sperm donation to create her own family. Being a single-mother-by-choice, Wendy understands firsthand the unique way families are built. Whether you’re a married couple, single, or LBGTQ, Creative Love is committed to assisting you.